FCA tells banks to take the lead on motor finance redress

Tags

The Financial Conduct Authority is bracing banks for an industry-wide redress scheme for customers mis-sold motor financing. The UK watchdog has outlined likely next steps ahead of next month’s Supreme Court hearing. Banks that delay being proactive risk scrambling to understand their affected customers, secure funding and put staff in place further down the line.

Valued at £51bn in 2023 and second only to the mortgage market in size, the motor finance sector is looking to prevent a financial upheaval that could mirror the £50bn-plus loss banks incurred for mis-selling payment protection insurance.

The FCA’s message is clear — a complaint-led approach, which relies on customers initiating complaints to get compensation, is unlikely to work. The onus is increasingly likely to sit with lenders to proactively compensate customers.

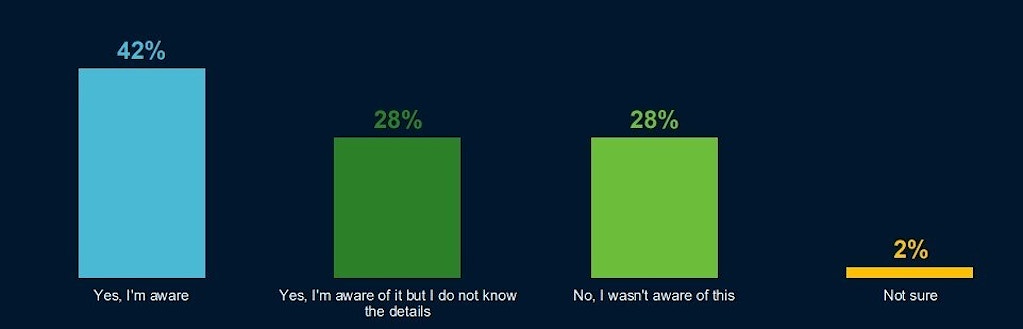

We have been here before. For the British Steel pension redress scheme, the FCA found that only 10 per cent of potentially affected customers had planned to complain proactively. Similarly, our recent survey of 2,000 customers who used car financing or leasing uncovered that 23 per cent don’t plan to make a complaint and 14 per cent are not sure.

Banks shouldn’t simply wait for the court ruling and the regulator’s final decision, as any redress scheme will require a heavy lift on their part. Given the time that has already elapsed, firms will likely be expected to move very quickly once the final rules are published.

The million-dollar question(s)

The FCA recognises that customers who have lost out should be compensated — regardless of whether they complain or not.

For firms, the question at the heart of any redress scheme is how to determine if a customer has lost out due to commission arrangements — and by how much.

The vast number of different commission arrangements used across the car finance sector between 2007 and 2021 complicates the task of creating a single redress calculator.

A single bank may have offered dozens of commission arrangements, various interest rates and allowed brokers the flexibility to adjust these rates. This may make it difficult for lenders to determine the exact terms each customer received, especially if the redress scheme extends all the way back to deals made in 2007.

Any redress calculator is, therefore, likely to undergo intense scrutiny and feedback.

The FCA needs to decide if the scheme will be ‘opt-in’ or ‘opt-out’, how firms should inform customers, what to do if customers don’t respond or can’t be reached, and how long lenders have to assess and make compensation payments. The watchdog will likely consult on this for at least three months before taking a further six months to finalise its policy.

Sold out?

- FCA announces in January 2024 it is examining discretionary commission arrangements on car loans issued between 2007 and 2021.

- Probe follows revelations dealerships and brokers set loan interest rates and earned higher commissions, leading to potential mis-selling.

- Court of Appeal ruling expands scope of the investigation in October, determining that paying a “secret” commission to car dealers without disclosing the terms to borrowers is unlawful.

- Redress could cost lenders, including Santander UK, Barclays and Lloyds, up to £44bn.

- If FCA’s fresh plan goes ahead, lenders must proactively contact affected borrowers and offer payouts — bypassing customer complaints and impacting claims management firms.

- Close Brothers and FirstRand hope to overturn the ruling at a Supreme Court hearing due to be heard April 1 to 3.

Get the groundwork in place

To prepare now, banks and other lenders urgently need to identify all customers who received finance with a discretionary commission arrangement. This means examining and organising complaints data and customer records.

Lenders should drill into the nature of their commission arrangements — including the range of rates in place, how much commission was paid, and the guidance or policies for these arrangements.

A complex data readiness exercise that involves sifting through historical data, banks may need to make reasonable assumptions where there are information gaps.

If banks don’t get their data in order now, they will be left scrambling around if and when a redress scheme is finalised, risking compliance failures, reputational damage and regulatory scrutiny.

Once the FCA clarifies the redress calculator, it will be essential for banks to develop a framework to assess if customers are eligible and, if so, how to quantify the harm and compensation.

Our research shows that only two in five consumers say they grasp the details of the motor finance scandal, and nearly half say it has undermined their trust in banks. This underscores the importance of clear, easily understandable communications.

Banks should prepare their operations and any technologies or tools needed, especially if they plan to use automated or GenAI tools to assess customer impact. These new technologies will be subject to scrutiny and may be less proven.

Consider the motor finance redress costs

It would be wise to assume that the total cost of redress will exceed payouts under a complaint-led approach. Previous compensation forecasts may need updating. Having the right funds in place — or access to those funds — well in advance will be essential.

Getting remediation right the first time will mean lenders are less likely to face regulatory scrutiny and be forced to reassess customer payouts — a big lesson learned from the PPI redress activity, where some firms had to make multiple compensation payments to customers where they had got the initial payment wrong.

While an industry-wide redress scheme may not be welcome news, it does at least put a time frame on the whole affair and give firms a greater element of control. After more than a year of uncertainty and upheaval, the FCA’s plans offer banks a more straightforward path.

They have a choice: react at the last minute and face high costs and operational stress or prepare for a smoother resolution.

It’s time for banks to flip the script on motor finance.

This article was first published in Banking Risk & Regulation.

Explore more